BingX is a social trading network that allows users to copy the trades of professional investors in the cryptocurrency market. BingX prides itself on being the best social trading network, providing a convenient and user-friendly platform for investors to access the expertise of pro traders by copy trades due the copy trade service.

Table of Contents

What Is Copy Trade?

Copy trading, also known as social trading, is a type of investment strategy that involves automatically copying the trades of other successful investors. In the context of BingX, copy traders are experienced investors who place orders on the platform, and other investors, known as followers, can choose to automatically copy these trades in their own accounts. By copying the trades of these pro traders, followers can potentially benefit from their market knowledge and successful track record.

What Is Copy Trade Pro?

CopyTrade Pro is an upgraded version of the BingX copy trading service that allows copy traders to place orders on the Binance exchange, while investors can copy these orders comfortably on BingX. This is accomplished by the copy trader connecting a read-only API (Application Programming Interface) from Binance to BingX. More information on how to set up BingX CopyTrade Pro can be found here.

What are the differences between CopyTrade Pro vs. Copy Trade?

CopyTrade Pro is a service that allows investors to copy the trades of professional investors on the Binance exchange through a read-only API on BingX. Transactions follow the rules of the external platform and are executed in the copy trader’s margin account. The size of the margin is determined by the ratio of the copy trader’s margin to the net asset value (NAV) of their USDT-margined futures account. CopyTrade Pro offers a wide range of trading pairs and has relatively low spreads, but is subject to the fees and trading limitations of the Binance platform. Copy traders earn a 10% profit share, which is settled weekly. Trading occurs in isolated margin mode only.

In contrast, Copy Trade is a service that allows investors to copy the trades of professional investors within the BingX platform. Transactions follow the rules of BingX and are executed in the investor’s standard contract account. The size of the margin is determined by the principal of a single trade. Copy Trade offers a limited range of trading pairs and has relatively low spreads, but is subject to daily limits on orders, a maximum leverage of 10X, and certain trading volume limitations. Copy traders earn an 8% profit share, which is settled daily. Trading occurs in isolated margin mode only.

How to copy trade on BingX

Access the Copy Trading page. On the BingX mobile app, go to the Homepage and select Copy Trading. On the BingX web platform, go to the Homepage and select Copy Trading.

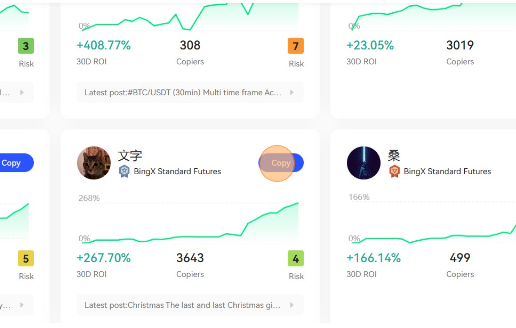

Select a trader to copy from. You can choose between different Trending traders, Conservative or Newcomers.

Click on the trader’s avatar to view their Share Trading Data or Feed. You can also click on any data indicator to see a definition.

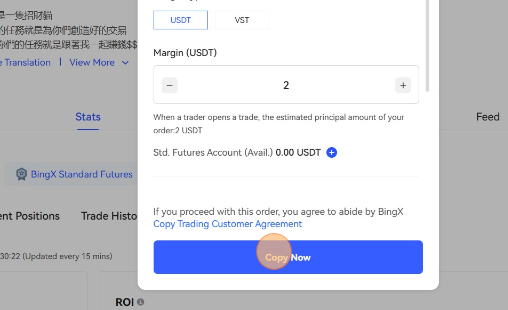

You can choose from three types of copy trading: copy by position, copy by a fixed margin, or copy by spot grid.

Once you have done this, you can choose the amount of money that you want to reserve for copy trading.

You have copied the chosen trader. Good luck!

How can I become a trader that users can copy on BingX?

To become a trader on BingX, you will need to meet certain requirements and complete a trader application process. According to the information provided, the requirements for applying for trader status on BingX include:

- KYC (Know Your Customer) authentication: This is a process used to verify the identity of customers and ensure compliance with anti-money laundering and counter-terrorism financing regulations.

- Deposit amount of at least 50 USDT: This means that you will need to have a minimum amount of cryptocurrency deposited in your BingX account before you can apply for trader status.

Once you have met these requirements, you can apply to become a common trader by clicking on the “Share Trading Activity” button on the “Share Trading” page through the BingX mobile app or PC web. Other users will then be able to search for you by your nickname in the Copy Trading Community and copy your orders accordingly.

How to become a ranking Copy Trader on BingX?

To rank high in the trader list on BingX’s copy trading service, you will need to meet certain criteria and have a strong track record of successful trades. On top of the requirements for becoming a trader, you need to:

- Achieve a trading volume of at least 100,000 USDT over the past 3 weeks: This means that you will need to have executed a significant number of trades over the past 3 weeks to be considered for a high ranking.

- Achieve a win ratio of at least 55% over the past 3 weeks: This means that you will need to have a relatively high success rate in your trades over the past 3 weeks to be considered for a high ranking.

- Achieve a cumulative return on investment (ROI) of at least 55% over the past 3 weeks.

Please note that profit generated from copy trading will not be taken into account in the ranking process.

What are the fees of copy trading?

The fees for copy trading on BingX will depend on the external platform being used for the copy trading. In general, you can expect to pay trading fees for each trade that is opened or closed, as well as funding fees for any positions that are held overnight.

For example, if you are using the Binance platform for your copy trading, you will be subject to Binance’s trading fees, which are currently set at 0.04% for both opening and closing a position. You will also be subject to funding fees, which are based on real-time market conditions.

What are the limits on orders for a trader on copy trade?

BingX has several limits in place for its copy trading service. These limits are designed to protect investors and ensure the smooth operation of the platform.

- Daily limits on the number of copied orders: BingX imposes a daily limit of 10 on the number of orders that can be copied by investors. If a trader’s orders exceed this limit, investors will be unable to copy them.

- Leverage limits to shared orders: BingX also imposes leverage limits on the orders that can be copied by investors. These limits vary depending on the trading pair being used. For BTC and ETH, the maximum leverage limit is 20X, while for other cryptocurrencies it is 10X. For non-crypto markets, the leverage limit is 20X. If a trader’s orders exceed these leverage limits, investors will be unable to copy them.

Why does my copy trading on BingX fail?

There are several factors that can cause copy trading to fail on BingX. Some of these factors may be due to issues on the copier’s side, while others may be due to issues on the trader’s side.

Factors from copiers’ side:

- Insufficient balance: If the copier does not have enough funds in their account to cover the margin requirements for the trade, the copy trade will fail.

- Copier’s holding position margin is greater than the set “Max. Opened Position Margin” limit

- Daily copy trading margin volume has reached or exceeded the set “Max. Daily Copy Trade Margin” limit

Factors from traders’ side:

- Traders open positions with excessive leverage

- Trades have reached the daily copy trading limit of 10 orders

- Traders open positions in cross-margin mode

- Traders open positions by using VST (Virtual Currency) as margin

- Traders open positions with bonuses