Home » Decentralized Exchange » Uniswap (UNI)

Launched in 2018, this trailblazing platform introduced the world to Automated Market Makers (AMMs), reshaping how we trade cryptocurrencies. With over $3 trillion in total trading volume, 465 million swaps completed, and $1.8 billion earned by liquidity providers,

Uniswap has cemented its place in the history books. Let’s dive into why Uniswap is the ultimate DeFi powerhouse.

Uniswap is a leading decentralized exchange protocol that enables users to swap and trade tokens directly from their own self-custodial wallets, without the need for intermediaries or centralized authorities.

Started on Ethereum mainnet, it has also expanded to practically all other EVM (Ethereum Virtual Machine) blockchains.

Launched in 2018, it has processed over $2 trillion in trading volume across 465 million swaps, making it the world’s biggest and most widely used decentralized exchange. With Uniswap being the fifth largest application on Ethereum with over $5 billion in total value locked (TVL).

Uniswap Labs is the company founded by Hayden Adams that develops the core Uniswap Protocol products like the web app, mobile wallet, and browser extension. Notably, no single entity controls the Uniswap Protocol. It is ‘governed’ by UNI token holders and stewarded by the Uniswap Foundation. Although this remains debatable…

Hayden Adams is the creator of Uniswap and was born in 1992 in New York, where he developed a strong interest in science and technology from a young age. He pursued a degree in Mechanical Engineering at Stony Brook University and worked as an engineer at Siemens. However, a layoff in 2017 led him to explore the world of blockchain technology and smart contracts.

Adams taught himself Solidity programming and became captivated by Ethereum’s potential for DeFi. While researching, he came across Vitalik Buterin’s blog post on automated market makers (AMMs). With a small development grant from the Ethereum Foundation, Adams built the first version of Uniswap.

This review of Uniswap (UNI) was created for informational purposes. This article is not intended for promotion.

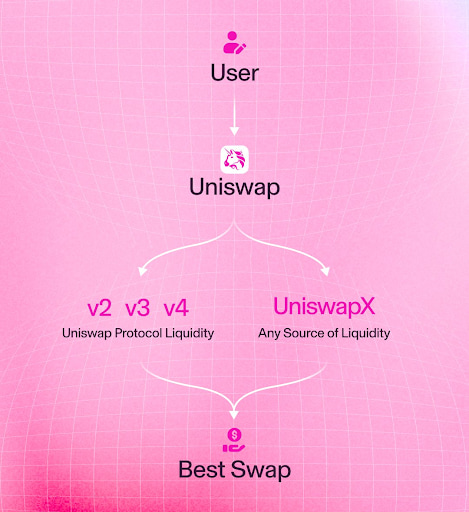

Uniswap’s uniqueness stems from several key features that distinguish it from traditional centralized exchanges and even many other decentralized platforms:

Uniswap operates entirely on decentralized protocols without any central authority controlling the platform. Users trade directly from their own wallets, retaining full control over their funds at all times, with no third party able to take or misuse assets. While this is nothing new already, Uniswap was the first to make this popular.

As they were the first to introduce the Automated Market Maker, or AMM, which is the smart contract that manages Uniswap’s liquidity pools. An innovative system that enables automated and permissionless token swaps, eliminating the need for a traditional order book used by centralized exchanges or failed DEX’s.

The AMM continuously analyzes the supply and demand of token pairs within a liquidity pool, determining the real-time value of each token and providing efficient token prices for every swap.

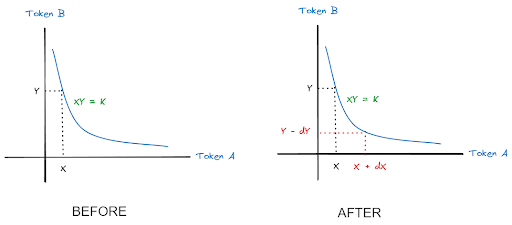

Also known as a Constant Function Market Maker, it maintains a constant balance between the tokens in a pool while adjusting their prices based on supply and demand.

AMMs rely on a mathematical formula to determine token prices based on the ratio of tokens in a liquidity pool. The constant product formula used is: x * y = k

When a swap occurs, the balance of tokens in the pool adjusts and the price changes along a predictable curve.

On Uniswap, anyone can swap, provide liquidity, or create new markets without registration, KYC, or approval. Although Uniswap blocks certain restrictions already and mirror sites are needed to access it from certain places around the world.

Liquidity pools are the backbone of the Uniswap protocol. These pools are essentially token pairs stored in a Uniswap pool contract, allowing users to swap between the tokens within the pool.

Unlike traditional exchanges, Uniswap relies on its users to provide liquidity to these pools. When a user contributes a token pair to a pool, they create market liquidity and enable token swaps.

To encourage users to provide liquidity, Uniswap offers compensation to liquidity providers. The incentivization mechanism has evolved through different versions of the protocol, from v2 to the latest v4. More on this later…

Anyone can become a liquidity provider by depositing equal values of both tokens into a pool. LPs receive pool tokens representing their share of the reserves and earn a portion of the trading fees (typically 0.20% per trade) added to the pool, which increases the value of their share over time.

The Pectra upgrade has brought EIP-5792 support to most smart wallets. This upgrade allows the Uniswap Web App to combine token approvals and swaps into a single transaction when connected to a compatible wallet. So what you’ll see in the image below will not be necessary anymore.

The Uniswap Wallet is a self-custody wallet that allows users to securely manage their onchain assets. The wallet is accessible across multiple platforms. It is available as a mobile app for both iOS and Android devices, making it convenient for users who prefer managing their assets on the go.

Additionally, it offers a browser extension for Chrome, enabling users to interact with decentralized applications (dApps) directly from their desktop. It is compatible with Ethereum, Base, Arbitrum, Optimism, Polygon, and ZKsync, among others.

Uniswap V4 takes a new approach. It introduces a single Pool Manager contract that handles all the liquidity pools. By consolidating pool logic into one contract, Uniswap V4 eliminates the need for deploying individual pool contracts. This change reduces gas costs by up to 99.9% compared to the V3 design.

Additionally, token swaps no longer require transferring tokens between different contracts. Everything is handled within the Pool Manager. You can stack multiple operations that create credits or debits, and the final token settlement happens at the end of the transaction.

Uniswap V4 introduces a singleton design where all tokens are held and custodied by a single contract.

Perhaps the most game-changing feature in Uniswap V4 is Hooks. Hooks are functions that execute custom logic before and after key pool operations. This allows developers to insert their own code at various stages of the pool lifecycle.

For example, developers can run custom code:

With hooks, developers can implement advanced functionalities like dynamic trading fees, custom pricing curves, and more.

The ERC-6909 token standard is designed to optimize the handling of multiple token types within a single contract.

In this system, when a user interacts with a pool involving ERC-20 tokens, such as providing liquidity, they have the option to leave their ERC-20 tokens in the Uniswap contract. Instead of transferring the tokens back to the user’s wallet, Uniswap mints an ERC-6909 token as a representation of the user’s claim to the deposited tokens.

This ERC-6909 token serves as a “receipt” or “IOU,” allowing the user to retain their claim while avoiding unnecessary ERC-20 token transfers. Later, if the user wishes to interact with the same pool or withdraw their funds, they can burn the ERC-6909 token to retrieve their original ERC-20 tokens from the contract.

Uniswap V4 adds native token support. You no longer need to manually wrap native tokens like ETH into their ERC-20 equivalents to use them in Uniswap. Uniswap V4 can handle native tokens directly.

In Uniswap V2 and V3, you had to wrap ETH to trade it. But V4 directly supports the native ETH token with no more wrapping required!

Also, the fees are handled differently, as the concept of fixed fee tiers is removed. Instead, you can have various fees like 0.04%, 0.22%. This changes the standard 0.25% fee on swaps to sustainably fund protocol development.

Developers are particularly interested in the dynamic fees feature. It allows them to freely express and adjust the fee, although there are still limits set by the protocol.

The Uniswap token, known as UNI, is the native governance token of the Uniswap DEX. Its primary purpose is to give holders the ability to participate in the governance of the Uniswap platform. It had a fee switch that was turned on and off during the existence of the exchange.

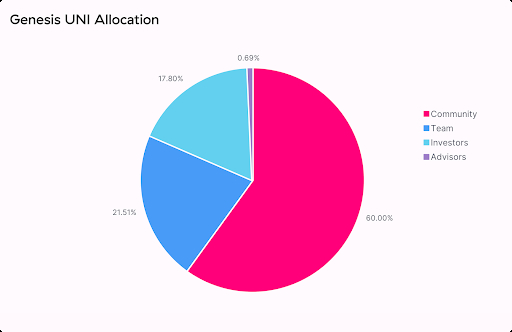

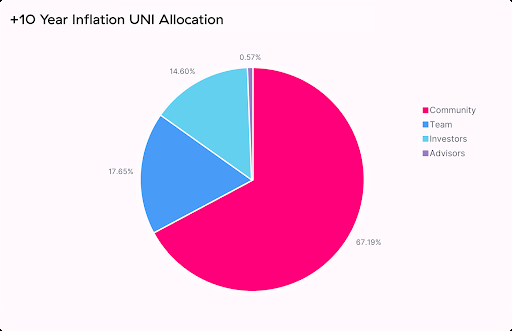

UNI has a total supply capped at 1 billion tokens, with a significant portion already distributed to users, team members, investors, and community reserves. The token address of Uniswap’s UNI token is:

0x1f9840a85d5af5bf1d1762f925bdaddc4201f984

UNI tokens were initially distributed as incentives to users who provided liquidity to certain pools on Uniswap.

Another portion of UNI tokens is reserved for the Uniswap treasury, which funds development, grants, and partnerships.

After 4 years, a perpetual inflation rate of 2% per year will begin.

15% of the total supply (150M UNI) was allocated to early community members:

Uniswap Governance is the decentralized system that allows UNI token holders to participate in the decision-making process for the Uniswap Protocol. UNI token holders can vote on proposals related to protocol upgrades, fee structures, and other key parameters.

Or they can delegate their voting power to other addresses, if they do not wish to vote directly themselves.

You can trade UNI directly on the Uniswap platform by connecting a compatible wallet (e.g., MetaMask). Uniswap supports swaps on Ethereum and other networks like Base, Arbitrum, and Polygon, allowing you to swap ETH or other tokens for UNI seamlessly.

Because Uniswap operates in decentralized space, you need to be extra careful and know what you are doing. So when using Uniswap, several important considerations should be kept in mind. Always be vigilant against fake websites and phishing attempts that are designed to steal your private keys or seed phrases from your own self-custodial wallet.

But also when swapping with contracts, you need to know concepts such as front-running and flash loan attacks that also came into existence with the introduction of these new ways of swapping crypto.

As of the latest updates and roadmap for Uniswap in 2025, they are planning to focus on the launch of Uniswap v4 and Unichain, which indeed offers all the new features discussed above.

Also, the Uniswap Foundation has proposed a substantial budget request totaling around $120 million for 2025-2026, which includes $95.4 million for grants and $25.1 million for operations, plus an additional $45 million for liquidity incentives. Their gigantic role is becoming more clear as DeFi matures as it is doing.

Uniswap stands as a trailblazer in DeFi, combining innovation, efficiency, and user empowerment. From its AMM model to its cutting-edge Uniswap V4 features, it has redefined decentralized trading. As crypto evolves, Uniswap remains at the forefront, setting the gold standard for decentralized exchanges.

Disclaimer: Trading and investing in cryptocurrencies (also called digital or virtual currencies, altcoins) involves a substantial risk of loss and is not suitable for every investor. You are solely responsible for the risk and financial resources you use to trade crypto. The content on this website is primarily for informational purposes and does not constitute financial advice.