Do you want to get more out of your cryptocurrency than just potential capital gains? BLOX Lending offers an innovative way for your crypto-assets to work for you. Discover how you can earn up to 5% annual return through Crypto Lending with BLOX.

Table of Contents

What is BLOX Lending?

BLOX Lending is a service that allows you to earn a return on your cryptos by lending them out. You activate Lending, and your coins are loaned to carefully selected parties. In return, you receive compensation. A unique feature of BLOX Lending is that your coins remain available for trading – they are not locked in.

What Are the Differences Between Lending and Staking?

Lending and staking are different methods for earning returns on your crypto holdings. Staking involves making coins available for validating transactions on the blockchain, while Lending means your cryptos are loaned out.

How Does Crypto Lending Work at BLOX?

With BLOX, you can participate in Crypto Lending simply through the BLOX app or website. You can activate or deactivate Lending at any time for any coin. While your coins are loaned out, they remain available for trading, without the need to stop Lending.

Can I Lend Just One Coin?

Yes, at BLOX you maintain complete freedom to choose which coin you want to lend. You can activate or deactivate Lending for each coin individually.

How Do I Activate Lending at BLOX?

Activating Lending at BLOX is straightforward:

- Open your BLOX account and navigate to the ‘earn’ tab.

- Read through the Lending information carefully on the website.

- Select the coin for which you wish to enable Lending.

- Review the risk information and then activate Lending.

Can I Still Trade with My Loaned-Out Coins?

Yes, your coins remain freely tradable, even when Lending is activated. You can stop lending at any time and sell your coins if you wish.

How Much Return Can You Earn with Lending?

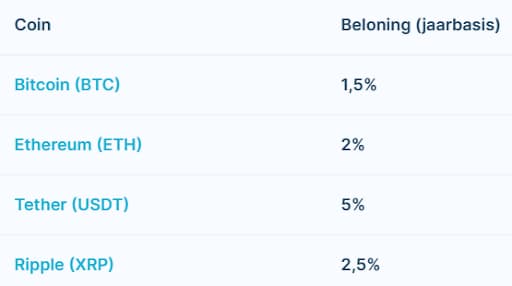

The return on BLOX Lending varies by coin, with rates between 1.5% and 5% annually. Your earnings are distributed weekly and added to the balance you are already lending, allowing you to earn interest on your interest.

Which Coins Are Available for Lending at BLOX?

Lending is available for coins with high trading volume and a healthy demand-to-supply ratio. Currently, you can activate Lending at BLOX for:

- Bitcoin (BTC)

- Ethereum (ETH)

- XRP

- USDT (Tether)

There are also several coins available for staking, found under the ‘earn’ tab in the BLOX app.

Examples of Earnings with Lending

- BTC Lending Example: Lend 1 BTC at an annual return of 1%, and after one year you would receive 0.01 BTC as a reward.

- ETH Lending Example: Lend 10 ETH at an annual return of 2%, and after one year you would receive 0.2 ETH as a reward.

- USDT Lending Example: Lend 1000 USDT at an annual return of 3%, and after one year you would receive 30 USDT as a reward.

With Lending on BLOX, you can put your investments to work and find a simple and effective way to grow your cryptos!

What Determines the Rewards of Lending?

The rewards for Lending can fluctuate depending on the supply and demand in the market. General market conditions also influence the returns.

Can Lending Rewards Change?

Yes, the rewards can change based on the market demand for loans. The current active returns can always be found in the BLOX app or web application. With this information, you can begin Crypto Lending at BLOX with confidence and potentially earn returns on your investments.

Are There Risks Associated with Lending at BLOX?

Yes, there are risks associated with Lending. Your cryptos are loaned out to third parties who may use them for various purposes. This brings credit risks, which means there is a risk of losing your loaned cryptos (or a part of them) if the borrower is unable to repay. Lending at BLOX is not covered by any deposit guarantee scheme or insurance, so you are responsible for any potential losses.