In this article, we will explain the basics of perpetual futures contracts on BingX, including how they work, and benefits of trading them, and the various factors that can impact their prices.

Table of Contents

What is the difference between perpetual futures and standard futures on BingX?

A perpetual futures contract is a type of financial derivative that allows traders to speculate on the future price of a cryptocurrency. It is similar to a regular futures contract, except that it does not have an expiration date. This means that traders can maintain their positions indefinitely, as long as they have the necessary margin to cover any potential losses

Leverage on BingX

In the context of perpetual futures contracts, leverage refers to the ability to control a large position with a relatively small amount of capital.

For example, if a trader wants to enter into a position worth $100,000, but only has $10,000 in capital, they could use leverage to borrow the remaining $90,000 from a broker or exchange. This allows the trader to control a larger position than they could with their own capital alone, which can potentially increase profits if the trade goes in their favor.

Maximum leverage 150X

The maximum leverage that is available for a particular trading pair on BingX is 150X.

For example, if the BTC/USDT trading pair supports a maximum leverage of 150X, it means that traders can enter into a position with up to 150 times the amount of capital that they have available.

This can significantly increase potential profits, but it also increases the risk of potential losses, as the trader is responsible for the full amount of the trade, even if they only put up a small portion of the capital. Playing with 150x is playing with fire. Only risk small amounts when you’re feeling degenerate.

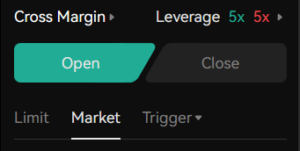

What are cross margin mode and isolated margin mode on BingX?

Cross margin mode and isolated margin mode are two different ways that traders can manage their margin and risk when trading perpetual futures contracts.

- In cross margin mode, all of the available balance of the relevant cryptocurrency is automatically used as margin for a trader’s positions.

- In isolated margin mode, a trader must set aside a specific amount of margin for each position that they hold.

Both modes have their own advantages and disadvantages, and which one is more suitable for a particular trader depends on their trading goals and risk tolerance.

Futures Fees

In the context of futures trading, there are typically two types of fees that traders may be charged: trading fees and funding fees.

Trading Fees

Trading fees are charges that are incurred when a trader buys or sells a futures contract. These fees are usually a small percentage of the trade value, and they are typically paid to the exchange or broker that facilitates the trade. There are usually two types of trading fees: taker fees and maker fees.

- Taker fees are charged to traders who execute trades immediately, meaning that they take an existing order from the order book and complete the trade. In the case of the fees listed in your question, the taker fee rate is 0.075%.

- Maker fees are charged to traders who place orders that are not immediately matched with another trader’s order. These orders are placed on the order book and are executed when another trader’s order is placed that matches the original order. In the case of the fees listed in your question, the maker fee rate is 0.045%.

Funding Fees

Funding fees, are charges that are incurred when a trader holds a position in a futures contract for an extended period of time. These fees are typically paid or received every 8 hours, and they are based on the current interest rates for the underlying asset. The specific financing fee rates vary depending on market conditions and the terms of the futures contract, and they can be positive or negative. If the funding rate is positive, the longs pay the funding fee to the shorts. If negative, the shorts pay to the longs.

Please note that users only need to pay or receive funding fees when they hold positions at 00:00, 8:00, and 16:00.

What is BingX liquidation explained?

In the context of trading futures contracts, liquidation refers to the process of closing out a trader’s position in a contract due to insufficient margin. When a trader’s margin falls below a certain level, known as the maintenance margin, BingX may automatically close out the trader’s position in order to protect against further losses. This process is known as forced liquidation, or a margin call.

Margin Rate <= Maintenance Margin Rate + Taker Fee Rate

How is the last price/index price determined?

The last price or index price of a perpetual futures contract offered by BingX is determined based on a weighted average of spot market prices from the exchanges Binance, Huobi, and OKX. BingX may also use prices from other exchanges, such as Gate.io, and MEXC, as part of its calculation of the last price or index price. It is also mentioned that BingX may add or remove exchanges from its reference list depending on actual conditions.